Other drug and biotech names also swung on clinical and partnership headlines. SBioMedics jumped nearly 20% as its U.S. Phase 3 plans for a Parkinson’s cell therapy came into clearer view while Peptron fell for a second session amid investor worries that a key agreement with Eli Lilly and Co. could take longer than expected even as some analysts argued the extension could ultimately be positive.

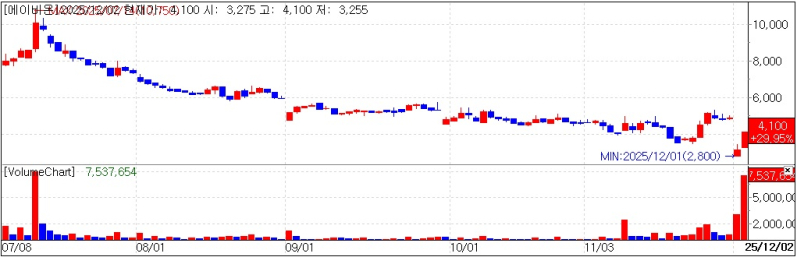

Abion stock trend. (KG Zeroin’s MP Doctor)

◇ Abion Capital raise then bonus shares

Abion shares hit the upper limit intraday and closed up 945 won at 4,100 won according to KG Zeroin’s MP Doctor (formerly MarketPoint). The rally followed a rights issue and an exrights adjustment tied to the ongoing bonus share issuance as investors focused on what the company said was an improvement in its financial position.

Abion has been running a stock offering and a bonus share issuance in tandem, saying the steps are intended to secure funding and enhance shareholder value.

On Nov. 28, Abion completed payment for a roughly 67.7 billion won stock offering designed to improve its “pretax loss” ratio under special listing rules for tech-based firms. Those rules require eligible Kosdaq companies to keep the ratio of pretax net loss to equity at 50% or less; if the ratio exceeds 50% at least twice over the past three years, the stock can be designated as an administrative issue.

Abion’s pretax loss ratio stood at 154.2% in 2024 and 230.1% through the third quarter of this year. After the offering proceeds were booked however the company said total equity rose to 77.1 billion won pushing the ratio down to roughly 28% and effectively removing the designation risk.

To offset dilution from the paid in offering Abion is also proceeding with a bonus share issuance at a rate of 0.8 new shares for each share held. The company said the new shares are scheduled to list on Dec. 24. Abion added that the move could also improve trading liquidity by increasing the number of shares outstanding.

“We’ve also faced criticism about liquidity” an Abion official said. “With more shares issued through this bonus issuance, we expect liquidity to expand.”

◇ SBioMedics U.S. Phase 3 preparations take shape

SBioMedics shares closed up 19.27% at 30,950 won, as investors bet that the company’s path toward a U.S. Phase 3 study of its Parkinson’s cell therapy, TED-A9, is becoming more tangible.

The company said it has effectively finalized a U.S. manufacturing partner for its clinical program, selecting global contract development and manufacturing organization Catalent after reviewing more than 10 candidates. S-BioMedics said it is now coordinating details of a definitive agreement.

The company and Catalent have already conducted an initial review of regulatory requirements for TED-A9 and are expected to begin technology transfer procedures soon, SBioMedics said. The partnership is aimed at supporting both clinical supply and potential future commercialization.

TED-A9 entered a combined domestic Phase 1/2a trial in 2023, with patient dosing completed in February 2024, the company said. In April it disclosed one year follow-up results reporting improvements in motor function as well as benefits on a measure of non-motor symptoms.

SBioMedics has been planning U.S. clinical development and said it held a pre IND meeting with the Food and Drug Administration in late October. The company said the FDA indicated it could be possible to proceed directly into a U.S. Phase 3 study based on the domestic Phase 1/2a data, prompting SBioMedics to begin preparations and pursue the CDMO deal.

“Our plan is to produce not only clinical material for U.S. trials but also commercial-scale supply through a U.S. based CDMO” a company official said.

◇ Peptron Shares fall on timeline worries, but some see upside

Peptron shares closed down 8.19% at 291,500 won extending a two day decline to 14.26% as traders reacted to concerns that a full contract with Eli Lilly related to obesity-drug development and manufacturing could be delayed.

Peptron last year signed a technology evaluation agreement with Lilly for its SmartDepot long-acting drug delivery platform working on a sustained release formulation of Mounjaro (tirzepatide). The original disclosure described the evaluation period as “about 14 months.”

On Monday Peptron filed a revised disclosure adding a condition that the term could extend “up to 24 months,” fueling speculation that the project may have encountered issues and pushing the stock lower.

Peptron however said the extension reflects a mutual decision to run additional in vivo studies for another peptide not a problem with the ongoing Mounjaro formulation work. In vivo studies evaluate drug effects safety and pharmacokinetics in living animals or within the body.

A local media PharmEdaily report suggested the extension could be interpreted positively arguing that Peptron’s work may be expanding to additional candidates, potentially including next generation obesity and diabetes assets Lilly is preparing.

Lilly has been accelerating efforts to address muscle loss, a known concern associated with GLP-1 class obesity treatments, the report said.

“Collaborative research applying the SmartDepot platform is progressing smoothly” a Peptron official said.