GemVax continued its steady climb after news that affiliate Samsung Pharm filed for conditional approval with the Ministry of Food and Drug Safety (MFDS) for a progressive supranuclear palsy (PSP) treatment candidate.

Hanmi Pharmaceutical also jumped about 10% after announcing a distribution deal for its obesity drug in development, signaling a push into overseas markets.

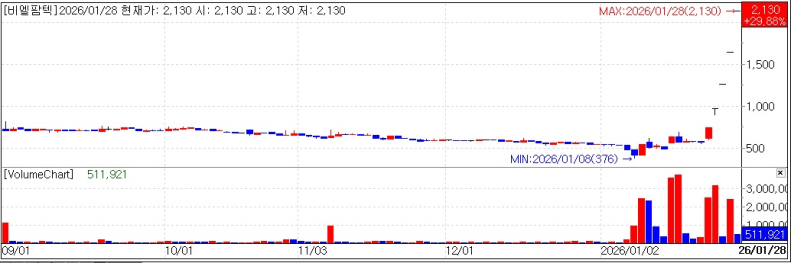

BL PharmTech Stock trend. (KG Zeroin)

◇BL PharmTech: Five straight limit-ups as molecular glue draws attention

According to MP Doctor (formerly MarketPoint) from KG Zeroin, BL PharmTech shares went straight to the daily upper limit from the opening bell. The stock has now hit the limit-up for five straight trading days, starting on Jan. 22.

The rally is widely attributed to growing expectations that negotiations to out-license BL PharmTech’s molecular glue platform are becoming more concrete.

On Jan. 15, Pharm Edaily pre-released to paid subscribers an article titled “In talks simultaneously with firms worth 6T, 11T and 26T won BL PharmTech targets trillion-won molecular glue mega-deal.” The article was later made free on portal sites on Jan. 22, drawing broader investor attention.

According to the report, BL PharmTech is currently in out-licensing talks with three Korean biotech companies. The reported counterparties have market capitalizations of roughly 6 trillion won, 11 trillion won and 26 trillion won, respectively names familiar to domestic investors.

Molecular glue is positioned not as a single pipeline asset but as a platform that can be attached to existing modalities including antibodies, antibody-drug conjugates (ADCs) and targeted therapies to potentially amplify therapeutic effects.

BL PharmTech holds a 34.91% stake in subsidiary BL Melanis, whose molecular glue technology drew attention after being selected as a final winner in Amgen’s “2025 Golden Ticket” program in November.

Beyond the platform, BL PharmTech also holds pipeline candidates including ML301 and ML302. The company is seeking partners for out licensing given that running clinical trials in house could be financially burdensome.

Global pharma interest in molecular glue type technologies has also been reflected in dealmaking. Last year, a European biotech company signed a multi-trillion-won deal with Boehringer Ingelheim for a similar molecular glue-related technology. Against that backdrop, BL PharmTech expects that a licensing deal could include an upfront payment of at least 100 billion won, with total deal value including milestones potentially reaching the trillion-won range.

A BL PharmTech official said molecular glue is a field with only a handful of credible players globally and said the company’s platform was recognized internally at Amgen as “quite powerful.”

◇GemVax: Shares up more than 20% on expectations for GV1001 conditional approval

GemVax shares rose 21.82% to close at 41,600 won. The stock has been climbing in recent sessions and is up about 79% since Jan. 22, fueled by expectations tied to Samsung Pharm’s conditional approval filing for a PSP treatment candidate.

On Jan. 27, Pharm Edaily published an analysis article titled “‘I’d like to try it once before I die’… GemVax makes high-stakes bet on conditional approval for GV1001” examining GV1001’s perceived strengths and market potential.

GV1001 was designated by the MFDS in 2024 as a drug candidate in development for a rare disease. GemVax said the conditional approval application targets PSP-Richardson syndrome (PSP-RS).

Under Korea’s conditional approval framework, the MFDS can grant early marketing authorization for therapies for life-threatening cancers and other serious or rare diseases based on Phase 2 results, while requiring submission of Phase 3 data after launch.

Samsung Pharm, under an agreement with GemVax, has secured rights to develop and commercialize GV1001 in Korea and four major Asian markets.

In a Korean Phase 2 study, GV1001 showed favorable tolerability and a trend suggesting a slowing of disease progression. In pooled data through a 72-week analysis including a 12-month extension, a PSP-RS subgroup showed a statistically significant difference versus an external control group in the change in total score on the PSP Rating Scale in the low-dose (0.56 mg) arm.

GV1001 has also received Fast Track and orphan drug designations from the U.S. Food and Drug Administration, and an orphan designation from the European Medicines Agency, which can provide regulatory support and incentives for global development.

A GemVax official said the company will continue to work closely with Samsung Pharm through commercialization in global markets.

◇Hanmi Pharmaceutical: Distribution deal in Mexico seen as first global foothold for a homegrown obesity drug

Hanmi Pharmaceutical shares rose as much as 15.79% intraday to 550,000 won, marking a 52week high. The stock later pared gains, finishing up 9.26% at 519,000 won.

The move followed Hanmi’s announcement that it signed an exclusive distribution agreement with Mexican pharmaceutical company Laboratorios Sanfer covering its GLP-1 obesity drug candidate efpeglenatide and its diabetes combination therapy lineup, the Daparone family.

Under the agreement, Hanmi will supply finished products including efpeglenatide and the Daparone lineup (Daparone and Daparone Duo sustained-release) while Sanfer will handle regulatory approvals, marketing, distribution and sales in Mexico.

Mexico is viewed as a high-need market, with an obesity prevalence of 36.86% and a diabetes prevalence of 16.4%, according to the company. Demand is also strong for blood sugar control during weight loss treatment and maintenance phases, factors Hanmi said contributed to the deal’s strategic rationale and highlighted efpeglenatide’s potential for global expansion.

Expectations around partner Sanfer also factored in. Hanmi described Sanfer as Mexico’s largest private pharmaceutical company, with a broad commercial and distribution network across Latin America and in house R&D capabilities.

The company operates in Mexico more than 20 Latin American countries, and the United States, and recently expanded its footprint through the acquisition of biopharmaceutical firm Probiomed, positioning it as Mexico’s largest biopharmaceutical company.

A Hanmi official said the company plans to expand cooperation with Sanfer step by step across metabolic disease therapies and will also discuss additional product introductions and joint marketing strategies over the mid to long term.