◇Peptron climbs 7 days on Lilly optimism

According to KG Zeroin’s MP Doctor (formerly Market Point), Peptron closed at 384,000 won, up 49,500 won (14.8%) from the previous day. The stock touched 392,500 won intraday, marking a new 52-week high.

Peptron Stock Trend (Source: KG Zeroin MP Doctor)

The rally began on November 12, when ABL Bio Inc. announced its 3.8072 trillion-won technology transfer agreement with Eli Lilly and Company. Following the big-ticket deal, investors have been rotating into companies seen as potential next candidates for Lilly partnerships—chief among them Peptron, which signed a platform technology evaluation agreement with Lilly in October last year.

Market expectations heightened further this week as unconfirmed chatter spread that Lilly had requested additional testing on Peptron’s drug substances. “I did hear that Lilly wanted extra tests, but the stock has risen to a level that feels almost frightening,” one industry official said, noting that rumors have amplified bullish sentiment around a possible “big deal.”

Short sellers, however, are increasingly taking the opposite view. As of November 17, Peptron’s short balance value had surged 29.3% in one month, indicating that some investors see the recent gains as excessive and are positioning for downside.

With bullish and bearish bets intensifying ahead of a major milestone, analysts expect the stock to remain highly volatile until Lilly completes its evaluation of SmartDepot, Peptron’s long-acting drug delivery platform. The review period is listed at roughly 14 months, and the market expects completion around December 7.

A Peptron official commented, “Our joint research with Lilly is progressing smoothly with no particular changes,” adding that “there is nothing further we can disclose.”

◇CORESTEMCHEMON drops 22% on rights offering overhang

CORESTEMCHEMON opened lower and ended the session at 1,060 won, down 300 won (-22.06%).

CORESTEMCHEMON Stock Trend (Source: KG Zeroin MP Doctor)

During the shareholder subscription period held on November 3–4, CORESTEMCHEMON recorded a 71.56% subscription rate, leaving 5,687,467 unsubscribed shares out of the 20 million offered.

“This price movement reflects supply-demand pressure as unsubscribed shares became tradable,” a company representative said. “It is unrelated to our clinical, regulatory, or business progress.” The person added that all key clinical and business milestones remain on schedule.

On November 14, CORESTEMCHEMON submitted all supplementary documents requested by the Ministry of Food and Drug Safety (MFDS) for the label-change application of Neuronata-R, its ALS cell therapy. A final MFDS decision is expected by year-end. For global development, the company plans to hold a Type C meeting with the U.S. FDA in the first half of next year and aims to file a Biologics License Application (BLA) by late 2026.

CEO Gil-An Yang’s planned 1.7 billion-won on-market purchase will begin next week as scheduled. Yang fully participated in the rights offering and also announced plans for potential share cancellation and additional personal share purchases, signaling responsible management and commitment to shareholder value.

“Management remains firmly committed to building long-term growth fundamentals and strengthening corporate value,” the company said, pledging continued transparent communication.

Given CORESTEMCHEMON’s decline, market watchers say investors should monitor other companies currently conducting shareholder-allocated rights offerings—including Noul, SyntekaBio, Inc., DEEPNOID Inc. and ABION Inc.—as additional listing of new shares could trigger similar volatility. One industry analyst noted, “Some loss-making firms continue relying on rights offerings to address recurring financial strain. Investors should be cautious.”

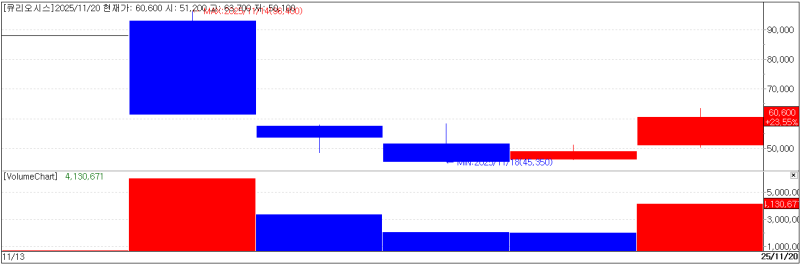

◇Curiosis rebounds 24% to reclaim 60,000-won level

Curiosis closed at 60,600 won, up 11,550 won (23.55%), reclaiming the 60,000-won range after four days.

Curiosis Stock Trend (Source: KG Zeroin MP Doctor)

Market participants attribute the volatility to the stock’s limited trading history. “Since we have only recently listed, liquidity-driven volatility appears to be high,” a Curiosis representative said.

Another industry official added, “Korea’s IPO market is increasingly dominated by short-term trading. Many stocks see a brief surge on debut day but struggle to maintain those levels afterward.”