During a briefing the previous day with the Ministry of Health and Welfare, the Ministry of Food and Drug Safety and the Korea Disease Control and Prevention Agency President Lee commented after hearing the Health Ministry’s report saying “There seem to be cases where young people feel unfairly treated because they pay insurance premiums but receive little benefit.”

He added “In the past hair loss treatment was regarded as cosmetic, but these days it is being perceived as a matter of survival” and said “It would be worth reviewing the cost whether by setting limits on the number of treatments or a total cap.” He also stated “If health insurance coverage is applied drug prices are said to fall so this should be reviewed.”

Alico Pharmaceutical hit the daily upper limit on news that it produces and sells generic versions of both the No.1 and No.2 hair loss drugs. Shinshin Pharmaceutical also saw a sharp rise on reports that it manufactures all minoxidil products sold in Korea. Withus Pharmaceutical gained after news that a long acting hair loss treatment requiring once monthly dosing recently filed an application for a Phase 2 clinical trial in Australia.

◇Alico Produces Top Two Generic Hair-Loss Drugs

The global hair-loss treatment market is dominated by two drugs finasteride and dutasteride. In Korea generic products have rapidly increased their market share driving growth in the hair loss drug market. Alico Pharmaceutical produces and sells generic versions of both finasteride and dutasteride.

According to KG Zeroin’s MP Doctor (formerly MarketPoint), Alico Pharmaceutical closed at 5,050 won, up the daily limit of 29.99% (1,165 won) from the previous trading day.

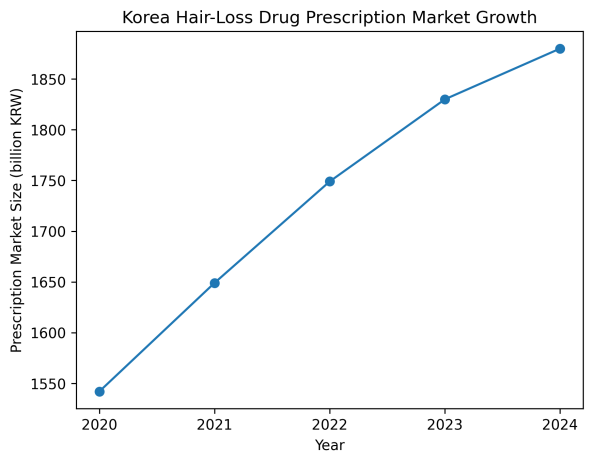

According to IQVIA the size of Korea’s hair-loss treatment market reached 1.88 trillion won last year. Prescription spending on hair-loss drugs increased from 1.542 trillion won in 2020 to 1.649 trillion won in 2021, 1.749 trillion won in 2022, 1.83 trillion won in 2023, and 1.88 trillion won last year. These figures cover prescription drugs used to treat androgenetic alopecia.

Combined sales of dutasteride based generics rose 85% from 267 billion won in 2020 to 494 billion won last year. Generics overtook the original drug Avodart in 2023, with a market share reaching 54% last year.

Sales of finasteride based generics totaled 618 billion won last year up from 483 billion won in 2020. The generic share of the finasteride segment rose to 65% last year.

An industry source said “Based on the growth of the hair-loss treatment market, Alico Pharmaceutical has expanded its capacity for stable production and supply of finasteride and dutasteride generics.”

The expansion of generics also affects patient access and drug pricing. Another industry source said “Original hair-loss drugs cost around 2,000 won per tablet, while lower-priced generics are typically priced between 200 and 300 won.” adding “Generics now form a major pillar of the domestic hair-loss drug market and could also have a notable impact if insurance coverage expands.”

◇Shinshin Pharma Makes All Domestic Minoxidil

Shinshin Pharmaceutical drew attention as the core manufacturing player in the over-the-counter minoxidil foam aerosol market.

On the day, Shinshin Pharmaceutical’s shares rose 1,210 won (22.32%) from the previous session to close at 6,630 won.

Recently, the Ministry of Food and Drug Safety approved four minoxidil foam aerosol products in succession all of which are manufactured under contract by Shinshin Pharmaceutical.

Approved products include Shinshin Pharmaceutical’s “Minoxy Foam Aerosol 5%,” Daewoong Pharmaceutical’s “Mobaren 5% Foam Aerosol,” JW Shin Yak’s “Mydeal 5% Foam Aerosol,” and Hyundai Pharmaceutical’s “MyNoxyl Foam Aerosol 5%.” While brand names differ, production is concentrated with a single manufacturer.

Minoxidil foam aerosol formulations are considered more convenient to use than liquid formulations due to lower viscosity and reduced dripping. The reference product for this formulation is Johnson & Johnson’s “Rogaine 5% Foam Aerosol” approved in 2016, which has largely defined the market to date.

An industry source said “Foam type minoxidil has faced high technical and facility barriers, limiting generic entry, but recent approvals are changing the supply structure.”

adding “Although multiple companies sell these products, manufacturing is effectively concentrated in one place.”

He added “As Daewoong Pharmaceutical, JW Shin Yak, and Hyundai Pharmaceutical compete for market share cumulative volumes for the manufacturer are expected to increase which is drawing investor attention.”

Shinshin Pharmaceutical also has experience producing prescription drugs containing finasteride, in addition to topical minoxidil products.

Topical minoxidil products used for hair regrowth. From left, clockwise: Hyundai Pharmaceutical’s “MyNoxyl,” Johnson & Johnson’s “Rogaine Foam,” and Dongsung Pharmaceutical’s “Dongsung Minoxidil.” (Photo courtesy of each company)

◇Withus Moves Monthly Hair-Loss Injection to Phase 2

Withus Pharmaceutical is developing a long acting injectable hair-loss treatment IVL3001 in collaboration with Daewoong Pharmaceutical and Inventage Lab.

The injectable formulation is designed for once monthly administration. IVL3001 completed a one year Phase 1 clinical trial in Australia generating human data for a long acting injectable hair loss treatment. No initial burst release considered a key risk for long acting injectables was observed.

On the day Withus Pharmaceutical shares rose 810 won (9.27%) to close at 9,550 won.

Inventage Lab announced on the 10th that it had completed submission of an Investigational New Drug (IND) application for a Phase 2 trial of IVL3001 for androgenetic alopecia to Australia’s Therapeutic Goods Administration (TGA). The company plans to submit an IND to Korea’s Ministry of Food and Drug Safety in the first half of next year and conduct trials simultaneously at four institutions in Korea and overseas.

Withus Pharmaceutical is responsible for contract manufacturing (CMO) of IVL3001. The company completed construction of a dedicated long acting injectable manufacturing facility in Anseong in 2023 investing 26.9 billion won. The plant is equipped with microfluidics based manufacturing systems and process validation and technology transfer procedures have been completed, leaving production infrastructure ready for IVL3001 clinical trials.

Withus Pharmaceutical headquarters.

adding “Based on the production infrastructure established at Withus Pharmaceutical, we plan to proceed with global clinical development and technology transfer.”